Government Budgets aren’t just about fiscal policy, recent history proves that they can also shape business confidence. Data from the British Chambers of Commerce Quarterly Economic Survey (QES) shows that UK Government Budgets have consistently had an impact on business sentiment. The 2022 mini-budget to the 2024 Budget showed how easily those nerves can be stirred again.

With the UK Government set to unveil its latest Budget on November 26 and the BCC’s latest findings from the Quarterly Economic Survey (QES) released just last week, it is possible to track how this unparalleled indicator of UK business sentiment has responded to previous fiscal events.

In the years following the pandemic, business confidence in the UK has never quite settled and remained steady for long. Among the jolts that defined it, two stand out: the 2022 mini-budget, which sent markets reeling, and the 2024 Budget, which saw the increase in employer National Insurance Contributions (NICs) – a big shock to firms. Together, they mark how fiscal policy can move business sentiment as sharply as any external shock.

The mini-budget shock: a confidence freefall

In September 2022, the government unveiled a package of aggressive tax cuts and fiscal stimulus, dubbed “The Growth Plan”, without submitting its measures to the Office for Budget Responsibility for scrutiny. The intent was to spark growth; the result was turmoil. Sterling plunged, gilt yields surged, and within days the Bank of England intervened to stabilise markets.

The BCC QES captured the fallout. In Q3 2022, confidence indicators deteriorated sharply: only 33% of firms reported increased domestic sales (down from 41%) and just 44% expected turnover to rise (versus 54% in Q2)[1]. Profit expectations and cashflow indicators all turned more negative.

That mini-budget event acted as a stress test for confidence. It exposed how fragile firms’ expectations were to fiscal policy shocks. The bounce back after markets stabilised was modest, and confidence remained on edge.

The long hangover: 2023 into early 2024

After the turbulence of late 2022, business sentiment showed some recovery during 2023, even amid persistent headwinds such as inflation, supply constraints, and weak productivity. But the baseline remained lower than before the pandemic. Firms were more cautious about investing, less prone to assume benign conditions, and more sensitive to tax or regulatory changes.

Other forecasters and think tanks described the same pattern. The National Institute of Economic and Social Research (NIESR) repeatedly warned of subdued investment and a cautious hiring stance, even in forecasts that assume modest growth[2]. Meanwhile, the Resolution Foundation emphasised that stagnant productivity and squeezed real incomes meant that businesses had less margin for error and were more easily rattled by policy shifts[3].

The 2024 Budget: a renewed drag on confidence

When the 2024 Budget arrived under Chancellor Rachel Reeves, the policy tone had changed. Instead of unfunded tax cuts, it carried a heavy tax burden. Most notable for firms was the increase in employer NICs. The intention was to restore fiscal discipline, but it landed awkwardly with firms already squeezed by costs.

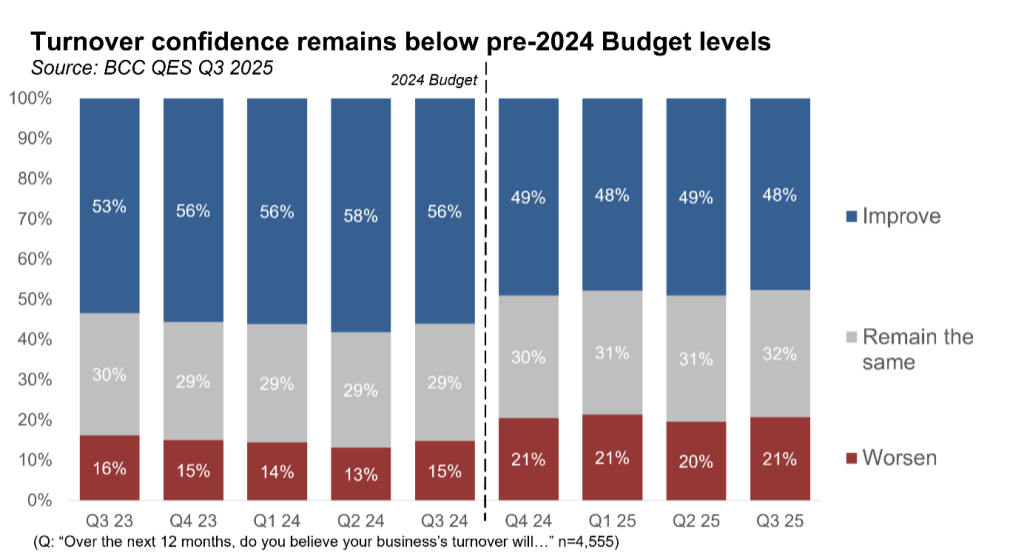

In Q4 2024, in the BCC QES, confidence dropped to its weakest point since the aftermath of the mini-Budget in Autumn 2022[4].Only 49% of firms anticipated turnover growth (down from 56%), and 20% reported reducing investment plans. Tax (including national insurance) surged to the top of firms’ concerns. 63% now cited growing worry about taxation, up from 48% in Q3.

The fall in business morale was not confined to BCC surveys. The Institute of Chartered Accountants in England & Wales (ICAEW) recorded its own morale index plunging in Q4 2024 to 0.2, its lowest since Q4 2022[5]. The ICAEW survey noted “record concerns” about the tax burden and weakened domestic demand.

Yet the 2024 Budget did not provoke a financial meltdown. The tremor was one of morale, not solvency. A collective and persistent sigh of frustration rather than a scream of panic.

Interpretation and implications

Taken together, the 2022 and 2024 fiscal episodes bracket a period of persistent fragility. The first hit confidence through chaos, the second eroded it through a lack of economic narrative.

What does that tell us about business confidence in today’s economy?

- Heightened sensitivity to fiscal signals

Firms appear to have a much lower tolerance for “bad surprises”. Even ostensibly modest tax adjustments can provoke outsized responses in sentiment. - Policy sequencing matters

A government seeking to rebuild confidence may find that bold “growth” signalling is less effective than incremental reassurance: stable tax regimes, clarity on regulation, and predictable policy environments. - Structural headwinds magnify policy risk

Because baseline growth is weak, firms have less slack. Therefore, a policy misstep looms larger in the downside risk calculus.

In sum, post-pandemic confidence has never fully recovered, but what the 2022 mini-budget and the 2024 Budget show is how fiscal events can act as jolts returning sentiment to fragile ground. For business confidence to gain a steadier foothold, the upcoming fiscal statement will need to not only deliver growth, but to cultivate credibility, consistency, and sensitivity to the recent experience of Britain’s businesses.

Further reading

QES Q3 2025: https://www.britishchambers.org.uk/news/2025/10/bruised-firms-not-ready-for-another-budget-battering/

BCC Insights Unit publications: https://www.britishchambers.org.uk/insights-unit/publications-and-commentary

[1] https://www.britishchambers.org.uk/news/2022/10/business-confidence-declines-significantly-quarterly-economic-survey-q3-2022/

[2] https://niesr.ac.uk/wp-content/uploads/2025/08/JC883-NIESR-Outlook-Summer-2025-UK-v6-1.pdf?ver=2UOll5Jx38dVTS3ZVFNz

[3] https://www.resolutionfoundation.org/app/uploads/2025/04/Yanked-away.pdf

[4] https://www.britishchambers.org.uk/news/2025/01/budget-tax-hike-bursts-business-confidence/

[5] https://www.reuters.com/world/uk/uk-business-morale-sank-2-year-low-late-2024-accountants-say-2025-01-15/