New polling on the initial reaction to the Greenland tariff threat

David Bharier, Head of Research, British Chambers of Commerce

Donald Trump’s latest threat to impose tariffs on UK goods over Greenland has landed with less shock than exhaustion. New polling by the British Chambers of Commerce Insights Unit of 342 UK businesses shows a third (33%) of firms exposed to the threat of new US tariffs are already taking action[1]. While exposure remains uneven, uncertainty is widespread, and tolerance for prolonged trade noise appears to be wearing thin. For many firms, this no longer feels like a discrete trade dispute, but another episode in a rolling cycle of tariff threats that underpin a perpetual cycle of economic confusion.

A shift in the nature of tariff risk

On 17 January, Donald Trump announced that the UK, alongside several European countries, could face a 10% tariff on goods entering the US from February unless they accepted Washington’s position to acquire Greenland. This could then rise to 25% by June. The President has provided little clarity on how the measures would be applied, including whether they would stack on top of existing tariffs or which goods would be affected.

Unlike previous tariff actions, which were framed around perceived trade imbalances, these measures are being presented explicitly as a geopolitical tool. Tariffs are being used not to correct economic distortions, but to exert pressure in support of territorial acquisition, reinforcing the new reality that coercion, rather than rules or institutions, sits at the core of international economic relations.

No executive order has yet been issued, but past experience suggests that implementation could follow at short notice. If applied broadly, the tariffs would affect around £60bn of UK goods exports to the US, implying additional costs of roughly £6bn initially, rising to £15bn if the higher rate were introduced in June.

How UK firms are responding

Using its unique access to companies across the UK, the BCC Insights Unit carried out a snap survey of nearly 350 businesses over a 24-hour period following Trump’s announcement, mirroring the rapid polling undertaken after the ‘Liberation Day’ tariff announcement in April 2025. The results point to a clear shift in sentiment since last year.

The research shows that 33% of businesses say they are exposed to the threat of new tariffs. Meanwhile, 21% say it is too early to judge their exposure, and 46% say they do not expect to be affected.

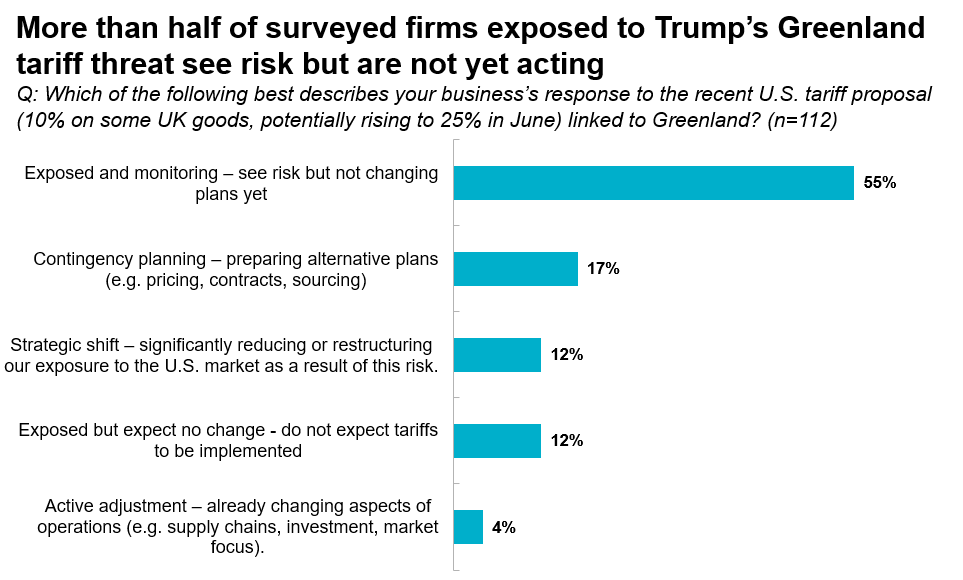

Among firms that expect to be exposed, most are cautious rather than reactive. A majority (55%) say they recognise the risk but have not yet changed their plans. However, one in three exposed firms (33%) say they are already taking action in response to the announcement.

Of those exposed, 17% are carrying out contingency planning, while 12% say they are planning a strategic shift to reduce exposure to the US market. A smaller group (4%) report active operational adjustments, such as changing supply chains or investment plans. A further 12% say they expect to be exposed but do not anticipate any change, because they believe the tariffs will not ultimately be implemented.

Among the many case studies collected by the Insights Unit, one retailer in Northern Ireland said the tariffs made “consumers cautious about spending, so my orders dropped from overseas,” while a small firm in Lancashire reported that potential clients “have cancelled a significant project… planned UK production will now move to China and US investment has been shelved.”

Firms have already had one year of geopolitical chaos

Ordinarily, an announcement of this magnitude might have prompted a sharper reaction. Instead, firms appear fatigued after nearly a year of repeated tariff threats, reversals, and escalation. Many have learned that reacting too hastily to announcements that may be delayed or abandoned can be costly. At the same time, prolonged uncertainty makes it harder to commit to investment. The result is a gradual slowing of decision-making and a tendency to tune out of the noise.

Financial markets so far appear to be reflecting a similar judgement. In contrast to the sharp sell-off seen around the April 2025 ‘Liberation Day’ announcement, the S&P 500 fell by only around 2% when it opened on 20 January, suggesting investors are increasingly pricing in trade volatility as routine rather than exceptional.

A harder edge to how firms would like to respond

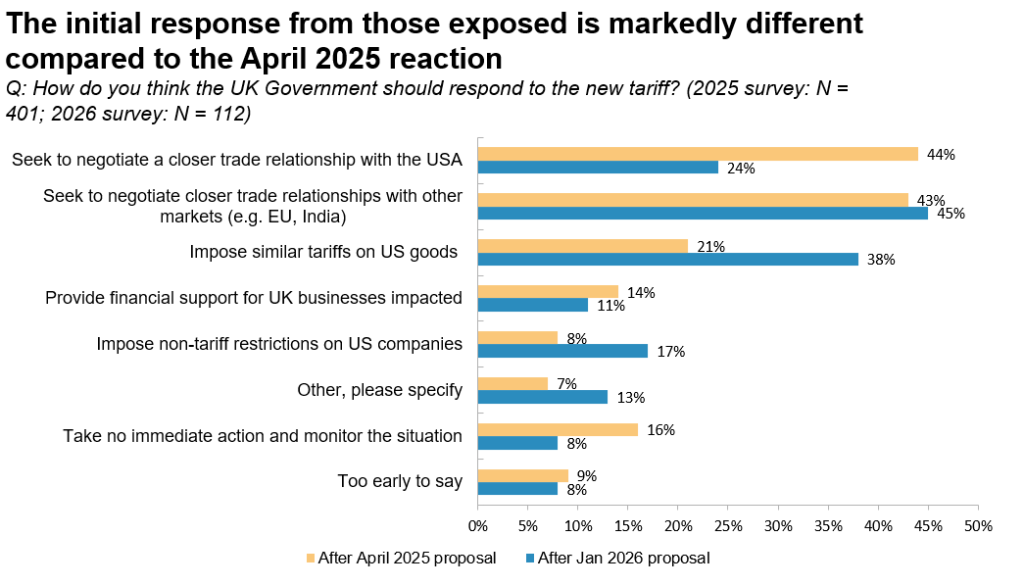

This fatigue is also beginning to shape how firms think about the UK government’s response. Among those exposed, views appear firmer than last spring, not because businesses are seeking confrontation, but because tolerance for prolonged uncertainty is diminishing.

The key message remains diversification rather than disengagement. Nearly half (45%) want the UK to prioritise closer trade relationships with other markets, such as the EU and India, broadly in line with sentiment after the April 2025 ‘Liberation Day’ tariffs. However, a key point of departure from last year is that far fewer now see US negotiations alone as sufficient to manage risk, with support for that option falling from 44% to 24%. In its place, support for more robust measures has increased, a clear reflection of the frustration felt by firms.

Looking ahead in a fragile economic backdrop

These developments come at a time of already weak business confidence – with the BCC’s Quarterly Economic Survey showing continued declines in sentiment. This is primarily driven by domestic tax pressures and fiscal uncertainty but US tariff policy has added a further layer of instability, hitting planning and investment decisions.

The immediate dispute over Greenland may yet prove to be another negotiating tactic, and legal constraints in the US could limit the use of tariff powers. For businesses, however, the core issue is not any single announcement but the cumulative effect of persistent uncertainty.

With trade volatility now a structural feature of the global system, the priority must be to strengthen the UK’s export support framework. That means improving the mechanics of trade – reasserting rules-based processes, digitising systems, and making targeted improvements in key markets such as the EU – while ensuring firms can fully access new opportunities, including newly negotiated FTA-markets like India. It also requires a renewed push on practical export support, through trade accelerators and stronger financing.

Global trade remains one of the UK’s few credible routes out of its low-growth trap. Preserving that opportunity will require a more strategic and coordinated approach to supporting exporters.

Further readings

- April tariffs snap poll: https://www.britishchambers.org.uk/news/2025/04/extent-of-us-tariff-impact-revealed/

- BCC Insights Unit research and publications: https://www.britishchambers.org.uk/insights-unit/publications-and-commentary/

[1] https://www.britishchambers.org.uk/news/2026/01/impact-of-us-tariff-threat-revealed/