New Polling Reveals a Public Split on the UK’s Fiscal Future

David Bharier, Head of Research, British Chambers of Commerce

Aaron Iftikhar, Director, Stack Data Strategy

Tomorrow, the Chancellor delivers her second Budget, and it is no longer just another fiscal event. It has become a critical juncture for the UK economy. With weak growth, diminishing fiscal headroom and rising pressure on public services, the government now faces a trilemma: meet the fiscal rules, protect spending, and avoid raising taxes on working households. The difficulty is that the UK cannot do all three at the same time.

But what path would businesses and the public choose if they were the Chancellor?

Exclusive new polling from the British Chambers of Commerce and Stack Data Strategy, surveying 980 businesses and 1,503 members of the public, offers the clearest picture yet of sentiment heading into the Budget and how the country would manage the nation’s books if they were forced into the job.

Tax, Spend or Borrow? Differing Fiscal Instincts

If the public and businesses were handed the Chancellor’s red box tomorrow, they would take the country in noticeably different directions. The polling shows two distinct fiscal instincts: a public that tends toward a modestly more interventionist approach, and a business community that would broadly prefer tighter control of the public finances.

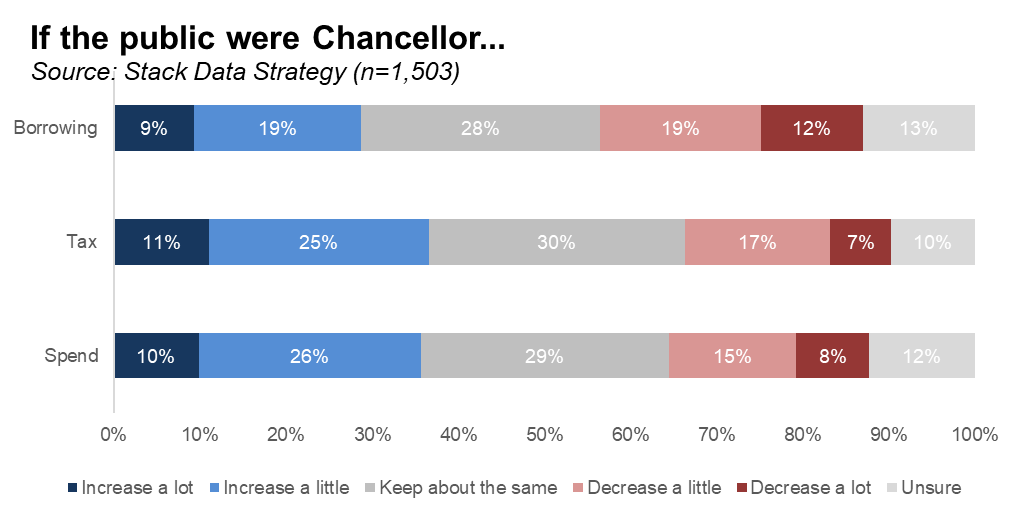

When asked how they would manage government spending, taxation and borrowing, members of the public are slightly more likely to lean toward increasing levels rather than reducing them. Around a third would increase public spending, while just under a quarter would reduce it. Taxation follows a similar pattern, with more people opting for higher taxes than lower ones, and a sizeable share preferring to keep things broadly unchanged. Borrowing prompts a mixed response: slightly more would look to decrease than increase. Overall, the public’s responses suggest a cautious preference for the state to do slightly more, even if this involves higher revenue and borrowing.

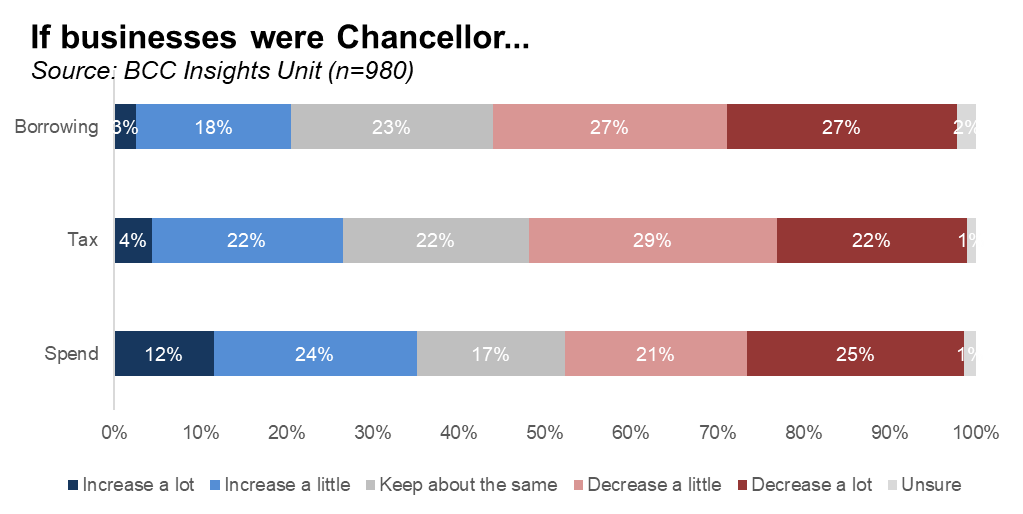

Businesses, by contrast, express a clearer preference for fiscal restraint. Almost half would reduce government spending, with only around a third supporting increases. The gap is even wider on taxation and borrowing.

Would Anyone Actually Want to Be Chancellor?

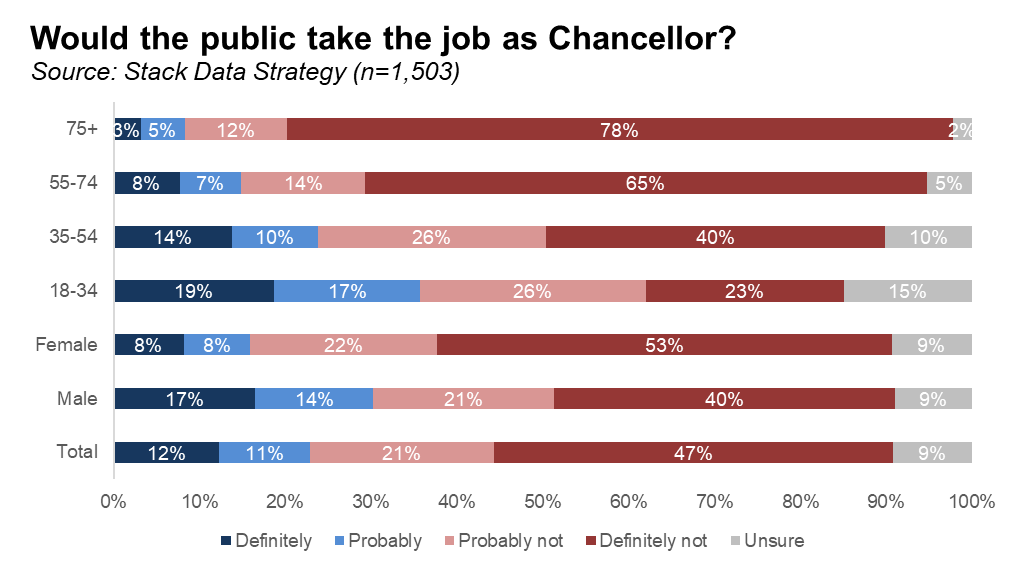

The role of Chancellor itself appears far from appealing to most people. Fewer than a quarter of respondents say they would definitely or probably take the job, while two-thirds say they would decline it. With nearly half firmly in the “definitely not” camp, the data suggest that the public recognises the scale and difficulty of the choices involved, and has little appetite for taking responsibility for them. There are however clear divergences within the population, with age standing out most clearly – younger adults are far more open to taking the job (35%) compared to over 75s (9%).

Heightened Anxiety Before the Budget

Beyond preferences, the polling reveals something deeper: the Budget has become a source of anxiety for both the public and businesses. Only a small minority of respondents feel very relaxed (5%) or fairly relaxed (18%), while the majority report concern, with 38% fairly worried and 26% very worried. A further 14% are unsure how they feel, reflecting the uncertainty surrounding the Budget’s potential impact. Anxiety is more acute among older age groups, while younger people are more likely to be unsure how the Budget will affect them.

Likewise, business sentiment worsened dramatically since the last Budget where tax rises, most notably on employer NICs, were announced. The BCC’s Quarterly Economic Survey shows that the vast majority of SMEs continue to report no improvement in conditions, with taxation cited as the top external factor of concern.[1]

Taken together, the findings point to a mixed picture. Public attitudes lean one way, business sentiment leans another, and there is no resounding consensus on the right fiscal path. What unites both groups is a growing anxiety about the Budget itself and what it may bring. A wider malaise is evident, and the fiscal trilemma is unlikely to be resolved through tax and spending choices alone. A clear narrative for long-term growth, underpinned by innovation, exports and investment in infrastructure, is the only realistic way to break the deadlock.

Join the conversation

See the full data tables here: https://docs.google.com/spreadsheets/d/1hECYqSkvseCH4BxFUD6B0dsf6SoAJ0Iy/edit?gid=152254747#gid=152254747

BCC Insights Unit research and publications: https://www.britishchambers.org.uk/insights-unit/publications-and-commentary/

[1] https://www.britishchambers.org.uk/news/2025/10/bruised-firms-not-ready-for-another-budget-battering/