Melanie Laloum, Lead Economist, International Chamber of Commerce and David Bharier, Head of Research, British Chambers of Commerce

Global trade is increasingly under pressure. A large-scale shift towards protectionism and tariffs has compounded a system already strained by post-Covid supply chain disruptions and global conflicts. In recent months, renewed tariff threats and the removal of the USA’s de minimis exemption for low-value imports highlight just how fast the environment is shifting. Meanwhile, trade digitalisation and AI could offer enormous upside potential, offering new ways for firms to strengthen resilience and unlock growth.

Against this backdrop, the ICC World Chambers Congress in Melbourne brought together business leaders and policymakers in September to reshape the trade conversation, calling for a more resilient, inclusive, and effective trade regime. To inform debate, the International Chamber of Commerce (ICC) published its second Global Economic Survey, Chamber Pulse: Global Markets, Local Landscapes, capturing the views of more than 240 Chambers of Commerce across 110 economies, representing 90% of global GDP.[1]

The findings paint a picture of businesses under pressure but also adapting in creative ways.

Trade conditions have worsened

The 2025 Global Economic Survey shows that trade conditions have deteriorated, with more than half of participating Chambers of Commerce reporting a worsening outlook. Concerns vary by region:

- North America: tariffs, inflation, and skills shortages.

- South Asia: taxation, tariffs, and geopolitical tensions.

- Latin America and the Caribbean: insecurity, unclear or unstable domestic politics, and inflation.

- Middle East and North Africa: geopolitical tensions, insufficient foreign demand, and access to finance.

- Sub-Saharan Africa: access to finance, tariffs, and competitive imports.

- East Asia and the Pacific and Latin America: Geopolitical tensions, tariffs, and skills shortages.

These global trends resonate with the UK picture. The BCC’s Quarterly Economic Survey shows that UK exporter sentiment has been on a downward trajectory since Covid, with more firms reporting worsening order books, squeezed margins from rising costs, and persistently low investment confidence.[2] Domestic tax rises and global tariffs have created a toxic mix for many firms already grappling with rising complexity.

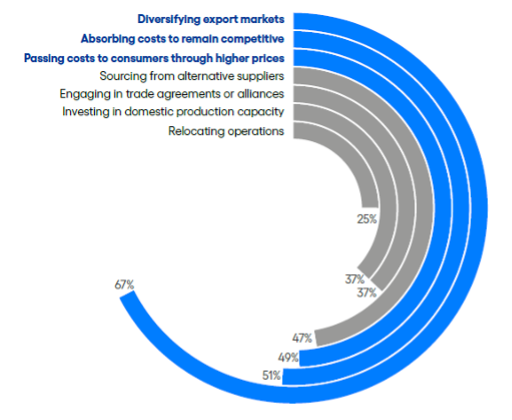

Businesses are looking to diversify

Amid heightened trade tensions, many Chambers are expecting supply chains to reconfigure. The survey shows that companies are not necessarily rushing to relocate operations but instead are pursuing market diversification and regional alternatives.

- East Asian firms are seeking to reduce dependence on North America and strengthening intra-Asian ties.

- European businesses are expanding within Europe and Asia.

- Latin American firms are deepening links across the Americas (outside the United States) while also looking to China and the EU.

- North American businesses, meanwhile, are reconfiguring supply chains by prioritising trade with non-Chinese partners and increasingly turning to Canadian and European markets.

Businesses’ strategies to mitigate trade-related risks, % of total responses

Source: ICC WCF (2025), Chamber Pulse: Global markets, local landscapes (2025 edition)

For the UK, this shift took place much earlier. Brexit gave UK exporters an early encounter with rising protectionism, and the effects remain widespread. BCC survey data shows that customs procedures are now the single biggest trade barrier, cited by 45% of firms.[3] A further 20% report having planned to establish or expand a commercial presence in the EU to navigate these barriers. While the new requirements have created widespread difficulties for SME exporters, a smaller but notable 9% say they have been prompted to diversify into non-EU markets have similar trading requirements.[4]

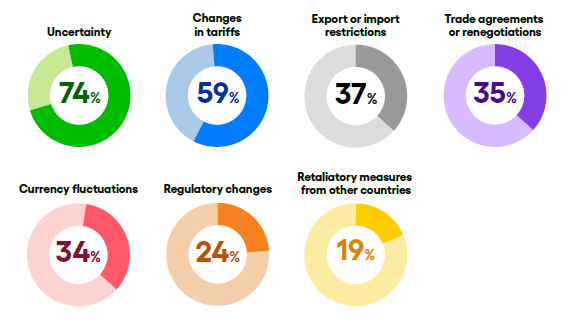

Uncertainty has become the biggest barrier

Perhaps the most striking ICC finding is that uncertainty itself has overtaken tariffs as the leading global trade challenge, cited by nearly three-quarters of chambers. This sentiment is strongest in Europe, East Asia and the Pacific, South Asia, and Latin America.

The UK is no stranger to this. BCC research shows that political and regulatory uncertainty has long been a drag on investment, often outweighing even cost pressures. Post-Brexit trade frictions, shifting domestic rules, and evolving global dynamics all add to the unpredictability that businesses face.

Trade policy shifts that impact and concern businesses, % of total responses

Source: ICC WCF (2025), Chamber Pulse: Global markets, local landscapes (2025 edition)

Trade digitisation could break the deadlock

Despite headwinds, the outlook is not uniformly bleak. Half of Chambers globally are optimistic about future business conditions, with the Middle East and North Africa standing out as the most confident. A neutral “wait-and-see” stance dominates in North America and South Asia, while pessimism is more pronounced in Latin America and East Asia. Chambers also anticipate inflationary pressures to intensify, particularly in North America and Latin America, where rapid price increases are expected.

In the UK, firms also see opportunities in digitalisation and trade deals such as the UK-India agreement, echoing the ICC’s emphasis on technology and diversification. The WTO estimates that artificial intelligence could boost the value of global trade by nearly 40% by 2040, with lower costs and higher productivity driving substantial gains. Yet without adequate policies, these benefits risk deepening existing divides.

Unless the multilateral trading system becomes more effective, inclusive, and fair, businesses face a fragmented future where uncertainty is the rule, not the exception.[5] The cost for the global economy would be considerable, especially for developing economies, with estimations pointing to a 33% collapse in developing countries’ goods trade and permanent GDP losses.[6] The challenge is clear: the trading system needs a multilateral approach to provide stability while recognising the potentially huge gains from advances in technology.

Keep up to date

ICC Global Insights publications https://iccwbo.org/news-publications/?fwp_select_topics=global-insights

BCC Insights Unit research and publications: https://www.britishchambers.org.uk/insights-unit/publications-and-commentary/

[1] https://iccwbo.org/news-publications/policies-reports/chamber-pulse-global-markets-local-landscapes

[2] https://www.britishchambers.org.uk/news/2025/07/trade-strategy-must-support-smaller-exporters/

[3] https://www.britishchambers.org.uk/news/2024/11/customs-procedures-still-holding-back-uk-exports/

[4] https://www.britishchambers.org.uk/news/2022/10/removing-trade-barriers-key-to-boosting-export-growth-of-uk-businesses/

[5] https://iccwbo.org/news-publications/news/how-to-fix-the-wto-a-holistic-framework-for-reform/

[6] https://iccwbo.org/news-publications/policies-reports/study-shows-wto-collapse-could-slash-exports-of-developing-countries-by-33-percent/