UK-India Trade Deal Explainer

UK-India Comprehensive Economic and Trade Agreement (CETA) Explainer

Information and key issues to watch from the Chambers of Commerce

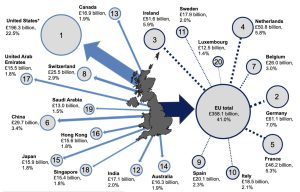

UK Trade in 2025

UK Goods and Services exports

Source: DBT

Goods exports to EU – £185bn

Goods exports to US – £59bn

Goods exports to CPTPP states-total – £31bn

Goods exports to China – £19.9bn

Goods exports to Gulf Co-operation Council

states-total – £17.39bn

Goods exports to Switzerland – £9.1bn

Goods exports to India – £7.6bn

Goods exports to Türkiye – £6.2bn

Goods exports to South Korea – £4.8bn

Goods exports to Norway – £3.6bn

UK-India Comprehensive Economic and Trade Agreement (CETA)

- Signed in July 2025 by Secretary of State for Business and Trade, Jonathan Reynolds, and Indian Commerce and Industry Minister, Piyush Goyal.

- UK ratification process underway – commencing with report laid before Parliament and referral to the UK Trade and Agriculture Commission.

- Legal text of the deal and double contributions convention published. CETA deemed to be compatible with Article XXIV of the General Agreement on Tariffs and Trade (GATT) and the General Agreement on Tariffs and Services (GATS).

- Expected to grow size of UK economy by £4.8bn annually by 2040 (+0.13% of GDP). DBT analysis also suggests an increase in public sector receipts by £1.8bn annually, in the long term.

- Expected to increase India’s GDP by 0.06%, or £5.1bn, annually in the long term.

- By 2050, India is likely to have 250m high income consumers, with demand for imports on course to exceed £2.8 trillion (DBT).

- India will remove or reduce tariffs, or retain pre-existing zero tariffs, on 90% of tariff lines, covering 92% of existing goods imports. Worth around £400m in tariff reduction on implementation of the agreement, rising to £900m over a decade.

- BUT sensitive sectors such as sugar, milled rice, pork, chicken, and eggs are excluded.

- 64% of tariff lines will be eligible for tariff-free import into India: £1.9bn of current UK exports to India.

- After phasing over 10 years, 85% of tariff lines and 66% of existing Indian imports from the UK will be eligible for tariff-free treatment.

- Annual exports to India, as of summer 2025, are 41% goods and 59% services.

Key Headlines On Goods Trade

- Imports from the UK of Scotch whisky and gin will see duties cut from 150% to 75% on day one, with staged reductions to 40% from year 10 onwards. Tariff reductions in the UK worth £220m to Indian exporters from day one.

- Forecast to raise UK goods exports to India by 60% in the long-term, £15.7bn by 2040, and raise UK goods imports from India by 25%.

- Increases bilateral trade by 39% over the long term (HMT Impact Assessment).

- Beverages and tobacco exports to India could rise by 180% in the long-term, compared with tariffs continuing at current levels (HMT Impact Assessment).

- UK car manufacturers benefit from a quota that reduces tariffs from up to 110% down to 10% with phasing, this will include EVs and hybrids over time. HMT forecasts in the long-term this could lead to 310% increase in automotive exports to India.

- Tariff-free access for UK agrifood, such as fresh and frozen salmon, cod, and lamb.

- Other UK food and drink exports such as chocolate, biscuits, infant formula, animal feed, protein concentrates and soft drinks will also see tariffs progressively removed.

- Tariffs on UK cosmetics and toiletries exports to be reduced through staging.

- UK and India have agreed to release goods as rapidly as possible after arrival at customs, within 48 hours if all requirements have been met and where no physical examination is necessary.

Key Headlines On Services Trade

- In applicable sectors, UK businesses will not face restrictions such as limits on the number of businesses able to supply a service.

- UK businesses will not need to set up a company in India or be a resident in India to supply their services.

- India will identify and encourage relevant bodies to enter into negotiations on mutual recognition agreements, or similar arrangements, for professional qualifications. These can streamline processes for UK professionals.

- Agreement supports innovation in financial services in both countries. This includes commitments on the provision of new financial services and cooperation on FinTech, RegTech and diversity in finance.

- Alongside promoting financial stability will also improve market integration.

Tariffs And Rules Of Origin

- Tariff reductions on UK goods imported into India worth £400m per annum immediately on CETA entering effect, rising to £900m per annum 10 years on.

- 64% of tariff lines from the UK will have zero tariff access to Indian market from day one.

- 85% of tariff lines from the UK, and two-thirds of actual trade in goods, covered by zero tariff access by ten years into the agreement.

- 99% of UK tariffs on India goods liberalised immediately at zero rate.

- Potentially reduces duties on India imports by £220m per annum based on full implementation of the new tariff preferences.

- Improvements to market access for UK advanced manufacturing and medical technology companies within the life sciences sector, and clean energy.

- Rules of Origin Chapter prevents fraudulent activities, such as circumvention, ensuring that only genuinely UK or Indian goods can access preferential tariffs.

- Product specific rules of origin appear straightforward, although UK automotive exporters will need to pay close attention to content requirements.

- To qualify for reduced tariffs, the rules of origin specify that a product must either be wholly obtained or significantly transformed by processing in either the UK or India. There are robust mechanisms for compliance to be checked.

- For importers in the UK, proof of origin will either be via an origin declaration completed by the exporter or producer, or a certificate of origin from an issuing authority, or importer’s knowledge that the good is originating.

- For importers in India, proof of origin will be an origin declaration completed by the UK exporter or producer.

- Usage of cumulation provisions and tolerances mean that the rules of origin should work for key exports from across the whole of the UK, including Northern Ireland.

- In the case of goods in Chapters 1-3, 5, 6, 10, 14 of the harmonised system, tolerances of up to 7.5% of non-qualifying input values or net weight will be permitted.

- In the case of a good in Chapters 4, 7-9, 11-13, 15-98 of the harmonised system, tolerances of up to 12.5% of non-qualifying input values or net weight will be permitted.

Technical Barriers to Trade Provisions

- More transparent trade through joint development of technical regulations on product characteristics.

- This will allow removal or reduction of technical barriers to trade for goods, including conformity assessments, product markings and labelling requirements – while upholding product safety and quality on the UK market.

- There are also provisions to assist with identifying and addressing future barriers to trade in goods, and the role of international standards.

Services Market Access

- Agreement locks in existing access for trade in services, substantially based upon WTO agreements, but without any extensive liberalisation on market access.

- No limits on numbers of UK companies eligible to provide a service.

- No residency requirements in India to provide a service to consumers or businesses.

- No requirement for a company to be established in India in order to provide services in sectors covered.

- More transparent and simplified processes for licence applications to provide services, and better information on the outcome of any processes to authorise these permits.

- Does not apply to, nor alter, the UK’s regulatory autonomy over UK public services, including health.

- Commitments on both governments to identify and encourage regulatory bodies to enter into negotiations on mutual recognition agreements, or similar arrangements, for professional qualifications.

- These could streamline processes for UK professionals seeking to have professional qualifications recognised in India and vice versa. Benefits include reduced administration, time, and costs, and greater certainty for businesses seeking to operate in the Indian market.

- A Professional Services Working Group to be established to allow officials, from both sides, to review and monitor implementation. It would also support relevant bodies in pursuing these objectives and the exchange of information on issues relating to professional services.

Financial Services

- Locks in UK firms’ ability to provide financial services to clients in India.

- On foreign direct investment, UK ownership or investment into Indian insurance or banking firms will be locked in at up to 74% UK owned or invested.

- Commits both sides to cooperate on issues like FinTech, RegTech and diversity in finance, alongside promoting financial stability, and upscaling market integration.

- Contains non-discrimination rules, so that UK firms are treated fairly when providing services in the Indian market. This includes a commitment that India’s rules and processes, on authorisation of UK firms to operate, is fair and transparent. Regulatory measures should be applied in a reasonable, objective and impartial way.

Temporary Movement of Natural Persons

- Confirms rules for business travel between UK and India for attendance at conferences, transfers to a branch of the same company in the other country, and the supply of services covered within a contract.

- Will provide clarity for a wide range of professional services sectors seeking to further their business interests or carry out work in the other market.

- Extends the contractual service supplier route to some additional sectors not previously available to Indian firms. In these sectors, those businesses could send their employees to the UK for up to a year to supply services on a contractual basis. This includes a quota for chefs de cuisine, yoga teachers, and classical musicians. This route will be limited to 1,800 people a year, and subject to qualification and experience requirements.

- Confirms access for independent professionals – so self-employed Indian nationals can enter the UK to deliver contracted services in the UK, in the listed sectors, for up to a year subject to qualifications and experience.

- No new visas or visa routes created. Standards, costs, fees and conditions to apply to work in the UK will not alter.

Mobility Arrangements and Entry of Indian Workers into the UK

- Specific salary thresholds for Indian workers coming to the UK under visas will also need to be satisfied. For example, for the Senior or Specialist Worker Visa, a worker must be paid at least £48,500 or the ‘going rate’ for that job – whichever is higher.

- Workers and employers would also have to cover all the costs of moving to the UK under visas.

- Indian workers coming to the UK, as a senior worker or specialist, would have to pay a visa application fee of £769, and an Immigration Health Surcharge (IHS) of £1,035 for any stay exceeding six months and up to 12 months, and a further £1,035 for each additional year.

- If the worker’s stay exceeds six months, employers would also need to pay the Immigration Skills Charge of £1,000 for the first year, and a further £500 for each additional six-month period. Employers must also pay £525 to issue a Certificate of Sponsorship.

CETA clarifies access for:

- Business visitors who travel to the UK or India for certain activities, including attending a conference or meeting with potential investors. They will have locked in access to apply for a visa which will allow them to travel for these temporary business purposes.

- Experienced employees and graduate trainees who transfer between a UK and Indian branch of their company. Referred to as intra-corporate transferees, these workers will be able to apply for a visa that lasts for at least 3 years.

- Investors who are employees of a business in the UK or India looking to establish and manage an investment in the partner country. This route allows senior managers or specialist employees, operating in the agreed sectors, to apply for a visa to travel to the other country for up to 12 months to set up the company’s first branch.

- Indian or UK professionals traveling to supply services on a contract for up to a year. This route is offered to all WTO countries for employees of a company in a limited number of sectors. Referred to as contractual service suppliers. CETA expands the number of sectoral workers eligible to apply for a visa to deliver services.

Intellectual Property

- Commitments in the deal based upon effective and balanced protection and enforcement of intellectual property rights. These build upon common international obligations including the WTO TRIPS agreement.

- Includes copyright and related rights, designs, trademarks, geographical indications (GIs), patents, and trade secrets, as well as enforcement of rights, and continued cooperation on IP issues.

- Speeds up patent processes in India and lowers administrative burdens while providing for transparency and certainty in patent rules.

- India agrees to engage on public performance rights and artists’ resale rights, together with a review on protection of works, performances, phonograms and broadcasts.

- UK eligible to apply for highest levels of protections available for geographic indicators on products in India, potentially extending these beyond wines and spirits, the only goods sector GIs currently receiving this higher-level protection in India.

Government Procurement

- The deal guarantees access for UK companies to Indian government procurement opportunities, ensuring that procurement in both countries will be fair, open and transparent.

- UK firms will be able to tender for a range of goods, services and construction procurement opportunities at central government level in India as well as in other state-owned entities.

- UK companies will be able to access information on published procurement tender notices in scope, free of charge, through India’s single website portal.

- UK firms will have access to bid for a proportion of up to 40,000 procurement opportunities per annum, based on most recent data.

- Under India’s Make in India policy, UK companies will be treated as a class 2 supplier if at least 20% of their product or service is from the UK. This grants them the same status as most Indian firms. The highest level of Make in India preference will still apply for approved ‘class 1’ suppliers offering half or more of their goods or services from India.

Competition, Subsidies and Consumer Protection

- Competition laws are to be applied and enforced in a non-discriminatory manner by independent authorities in both countries.

- Ensures procedural rights for persons and businesses under investigation by competition authorities, including the right to be treated fairly and to defend themselves.

- Promotes cooperation on the application and enforcement of competition and consumer protection policies and law.

- Provides for cooperation between UK and Indian authorities on the corporate governance of state-owned enterprises and for appropriate means to raise concerns where they arise.

- Enshrines transparency in granting of subsidies, and for appropriate means to raise concerns where these arise, complementing the processes available through WTO rules.

Telecommunications

- Commitments based on twin principles of transparency and non-discrimination.

- UK telecoms companies to have guaranteed access to facilities and services in India, on a transparent and non-discriminatory basis.

- Also provides for access to telecommunications networks and services for UK suppliers in India and guarantees that critical scarce resources are administered in an open and objective manner. Including spectrum and radio frequencies necessary for any wireless communication, such as usage of a telephone or smartphone to make calls or connect to the internet.

- Commits both sides to cooperation in international institutions on global standard setting.

Trade Remedies and Customs Facilitations

- Builds upon WTO terms on dumping, surges of imports, unfair subsidies, and countervailing measures to reach specific commitments on UK-India trade.

- Bilateral safeguards measures allow either side to temporarily raise tariffs or suspend tariff preferences if the trade deal leads to a surge of imports that causes or threatens to cause serious injury to domestic industry.

- Allows for trade to be rebalanced should the UK or India apply a bilateral safeguard measure.

- Both sides agreed to customs procedures in both countries which are non-discriminatory, transparent, and consistent. Simplified customs processes through deferred duty payments, after the entry of goods into free circulation.

- Release of goods within 48 hours of arrival at customs if all requirements are met and no physical examinations are involved.

- Customs details, laws, rules, processes and opening hours will be published in English language wherever possible.

Sanitary and Phytosanitary (SPS) Standards

- Twin aims of the agreement are the protection of biosecurity, plus removal of unnecessary trade barriers through improved structures and processes.

- Could lead to further removal of SPS barriers through equivalence assessments and recognition of regional conditions.

- Strong provisions and co-operation on animal welfare between both countries.

- Exchange of information and joint working on the importance of tackling antimicrobial resistance (AMR) and the global threat posed by it.

Digital Trade and Data

- Lowers barriers to digital trade and promotes compatibility of digital trading systems, including through support for legal recognition of e-contracts and e-authentication

- Businesses will be protected from forced transfer of their source code. Additionally, protects consumers transacting online. Unsolicited commercial messages to be minimised, by requiring consent or working towards making spam or junk messages clearly identifiable, such as by including who they are sent by or on behalf of.

- Terms on cross border data flows and data localisation, allows the UK the opportunity to negotiate updated rules with India, when they agree similar commitments with other trade partners. This does not affect the UK’s data protection standards, with all transfers of personal data continuing to be authorised exclusively under UK data protection law.

Small and Medium Sized Businesses

- The UK and India both commit to cooperation and information-sharing on the SME agenda. Both countries agree to reduce the trade barriers that SMEs face, through increased transparency and access to information.

- Includes obligations to establish contact points and facilitate the exchange of best practices, that make it easier for SMEs to enter the other market. Both sides will also make trade information accessible online and easier to understand, so that SMEs can clearly understand and navigate the other country’s systems and processes.

- Both sides may also explore how to further reduce trade barriers for SMEs and share best practice on important issues that may prevent SMEs from exporting, such as access to finance.

Good Regulatory Practice

- Promotes economic growth for the UK by encouraging good governance and accountability within regulatory processes. This will provide for a stable and predictable regulatory regime for UK businesses.

- Both sides will ensure that their regulations are made accessible. Both make commitments to provide a reasonable opportunity for interested persons to comment on proposed major regulatory measures, and to encourage regulatory authorities to cooperate on current and future regulation.

Environment

- The deal supports the UK’s climate and environment goals – including delivery of the Clean Energy Superpower Mission and the transition to net zero.

- Reaffirms UK and India commitments to global environmental agreements including the Paris Agreement and encourages the transition to clean energy.

- Commits the UK and India to strive to ensure their respective environmental laws encourage high levels of environmental protection, and not to waive their environmental laws to encourage bilateral trade or investment.

- Seeks to facilitate and promote trade in environmental goods and services, which could help the UK boost exports in key green sectors, such as clean energy industries, and drive economic growth.

- Supports cooperation on a broad range of environmental issues, including reducing air pollution, protecting biodiversity, tackling deforestation, and addressing marine litter. Also establishes a subcommittee on sustainability.

- Includes provisions that support cooperation and trade in key UK growth sectors such as clean energy, transport, recycling, and the promotion of a circular economy.

Innovation

- Seeks to improve support for innovation in the UK and India, including enhancing opportunities for innovation-intensive industries and encouraging trade in innovative products and services.

- Establishes an Innovation Working Group, allowing the UK and India to improve existing collaboration, research, and development. Discussions under this cooperative framework may cover a range of areas, including future regulatory approaches and supply chain resilience.

- Working group will also provide an opportunity for industry, academia and civil society to advise government on key challenges surrounding innovation and trade. Both sides will work together to achieve early identification and mutually beneficial resolution of unintended barriers to trade. This will include monitoring regulatory frameworks for new technologies and supporting businesses to maximize international trading ambitions.

Labour Rights and Standards

- A commitment by both sides to uphold international labour protections for workers, including protections on freedom of association and protection from forced labour in line with the obligations of their domestic legislation. Refers to common membership of the International Labour Organisation (ILO) and its standard setting role.

- Encourages good business practice and corporate responsibility, advances mutual ambition by both countries to tackle forced labour and gender discrimination in the workplace, and promotes decent working conditions. Also contains commitments for the effective enforcement of labour laws.

- Ensures fair competition for UK and Indian business through a commitment that neither country will selectively disapply their labour protections. Both countries continue to retain flexibility to regulate for domestic interests.

Gender Equality

- The agreement enhances the opportunities for women to access its full benefits. Also advances women’s economic empowerment and promotes gender equality through trade.

- Creates the space for the UK and India to work together to support women business owners, entrepreneurs, and workers to fully access and benefit from the opportunities created by the trade deal.

Transparency and Anti-corruption

- Commits the UK and India to transparency principles aimed at making relevant information open and available to all users of the deal.

- Both countries affirm their adherence to their key commitments on bribery and corruption in the United Nations international Convention against Corruption (UNCAC) and recognise the relevant principles adopted by the G20. Both agree to work together to tackle these global issues within the trade and investment context.

- Contains obligations to maintain a range of measures to prevent and combat bribery and corruption, including the criminalisation of bribery and prohibiting fraudulent records-keeping. It also includes provisions to stop facilitation payments, embezzlement and money-laundering while also protecting whistle-blowers.

- Provisions also cover cooperation between the UK and India on anti-corruption matters, as well as an ad hoc working group on bribery and corruption in trade.

Double Contributions Convention (DCC)

- The DCC ensures that employees moving between the UK and India, and their employers, will only be liable to pay social security contributions in one country at a time. It also ensures that employees temporarily working in the other country continue paying social security contributions in their home country, preventing fragmentation of their social security record.

- The terms are set out in a side letter to the deal.

- DCCs include a provision which allows employees (known as “detached workers”) to continue paying solely into their home social security scheme when they are temporarily working abroad for an agreed maximum period- in this case, 3 years.

- UK already has 47 DCCs in place with international partners based on an ILO model agreement including with the US, EU, Japan, Canada, Switzerland and South Korea.

- Arrangements made on basis of reciprocity, meaning that a UK worker temporarily in India for a maximum duration of 3 years would be treated in the same way.

- Under the DCC, there will be no “double contributions”, and the 52-week current reciprocal exemption period will be extended to 36 months for detached workers.

- Indian detached workers will not build entitlement to the UK State Pension or other contributory benefits. If a detached worker’s family member takes up employment in the UK, they will have to pay UK NICs.

- UK NICs exemption only applies to individuals who are living in India and who are already working for an India-based employer, but who are sent over to the UK for a temporary period of a maximum of 3 years. Exemption will not apply if the individual sent by their employer to work in the UK was intending to stay for more than 36 months.

Dispute Resolution

- The agreement will establish a strong state-to-state dispute settlement mechanism for resolving certain disputes, should they arise.

- Both sides have agreed comprehensive Dispute Settlement arrangemnets. These will ensure that trade disputes are dealt with in a consistent, fair, cost-effective, transparent and timely manner.

- Signals intent from both sides to uphold the agreement, providing greater certainty to businesses. Will also ensure the UK can enforce commitments by India that have been made under agreement, and vice versa.

- Ensures that dispute settlement proceedings will be suitably transparent, allowing interested businesses, non-governmental organisations (NGOs) and other entities to engage in the process, while safeguarding confidential information.

Governance and Institutional Arrangements

- Joint Committee to be established by both governments to oversee implementation and operation of UK-India CETA and the DCC.

- Sub-committees on goods; services; sustainability; sanitary and phytosanitary rules (SPS) rules; standards, technical regulations and conformity assessments.

- Working groups to be established for rules of origin; customs and trade facilitation; temporary movement of natural persons; innovation; trade and gender; procurement; intellectual property; anti-corruption; professional services.

- Agreement can be amended by consent of both sides – taking effect 60 days after written confirmation of necessary domestic approval processes is exchanged by both sides.

- Both parties have agreed review it within 5 years of the date of entry into force of the Treaty, and every 5 years thereafter, with a view to furthering the objectives and building upon its terms. There is an additional review clause in the digital trade chapter.

Ratification

- Expected to take around 12 months in the UK, but a shorter period in India.

- Initial steps: laying Command Papers before the UK Parliament. Reference to, and call for input from, UK Agriculture and Trade Commission (TAC) by end of August.

- After this report is issued, UK government will lay its own reports under the Agriculture Act 2020 (section 42 report) covering similar issues to TAC report alongside impacts of the CETA upon human life or health.

- Scrutiny of agreements by Parliament in terms of Constitutional Reform and Governance Act 2010 (CRAG) processes will be undertaken after that.

- Primary legislation required on permitting conformity assessment bodies registered in India to apply for authorisation through the UK Accreditation Service (UKAS) and approval by the UK Government and other aspects. Within current session of Parliament or after the next King’s Speech.

- Secondary legislation required to make changes to tariff schedule and quotas applicable to India, procurement rules, intellectual property rules and temporary movements of natural persons, among other changes.

- The deal will come into effect 60 days after final ratification notices are lodged by both countries.

What Next? Maximising Benefits for UK Traders

- Establish what the tariff reductions will mean for your goods exports to India, or if you are an importer, what lower tariffs mean for your UK supply chains and customers.

- Establish how the new tolerances and product specific rules of origin affect whether your goods can qualify for the new tariff preferences.

- Get advice from your local Chamber of Commerce on certificates of origin and other exporting tips. They can advise on marketing, customer base, customs, duty, tax and regulatory requirements. These can used to enter, or drive increased sales, in the Indian market when the deal comes into force.

- In services trade, work out how the deal may help your customer base in India increase.

- On personnel matters, make sure you understand the current rules on visas plus the new provisions on temporary entry, particularly for business purposes.

- Work with the Chamber Network to maximise the full potential for your business. The trade deal will allow cheaper, faster trade with the fast-growing consumer and business market in India for UK goods and services.